Credit Card Disputes FAQs

Before initiating a claim, consider calling the merchant first, as they may resolve your claim faster (we may also require information from the merchant to process a claim, so contacting them directly may save you time). Additionally, please note that only posted transactions can be disputed (pending charges are temporary and may change), so if you have any immediate concerns about a pending charge, you may want to contact the merchant. You can typically find the merchant’s contact information on your receipt or billing statement.

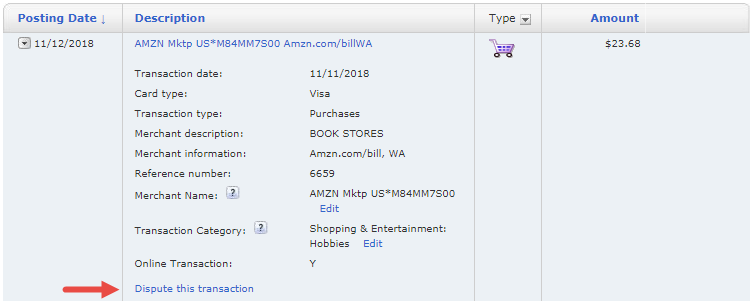

Online Banking customers can submit most credit card disputes directly from the transaction detail found in the Activity tab on your credit card account page, or from the Dispute a transaction link on the Information & Services tab.

To access the credit card dispute process, log in to Online Banking.

Not an Online Banking customer? Enroll in Online Banking today

Timely notification is important. Most transactions must be disputed within 60 days of the date of your statement on which the error appeared. If you did not provide your account information to the merchant in question and suspect that your information was stolen, please contact us immediately.

While our online dispute process is the easiest and fastest way for you to submit a claim, you may also write or call us. Please visit our credit card customer service page for additional information.

If you believe that a credit card transaction has been posted to your account in error, you may submit a credit card dispute within 60 days of the date that appears on the transaction statement or receipt. We will research the transaction with the merchant and their bank and contact you with the results. No fees or interest will be incurred on the disputed charge during the dispute process. If the transaction was posted in error, we will correct your account. If the transaction was not posted in error, we will inform you of any interest or fees incurred during the dispute process.

Many times disputed charges are legitimate charges that customers may not recognize or remember (you can log in to Online Banking and view details of your specific credit card transactions on the Activity tab of your account).

Before disputing a charge, we recommend you attempt to resolve the dispute with the merchant. Often the merchant can answer your questions and easily resolve your dispute. The merchant's phone number may be located on your receipt or billing statement.

If you believe there has been unauthorized use of your account, please contact us immediately by calling 800.432.1000.

After you submit your dispute of a credit card transaction, we may recalculate your minimum payment based on the total balance minus any balance in dispute (along with any fraudulent transactions and/or payment misposts to be researched). If the transaction was posted in error, we'll correct your account. If the transaction was not posted in error, you won't be charged any interest or fees associated with the dispute.

If you're set up for AutoPay or have a scheduled payment in 3 or more days, we'll review whether the scheduled amount needs to be adjusted in light of the dispute. If so, we'll reduce the scheduled payment amount to prevent you from paying into the disputed amount.

We take your business seriously and will do everything we can to help resolve a dispute in a timely and thorough manner. Our dispute department will research the transaction with the merchant and its bank and contact you with the results. We process disputes according to billing error procedures that are governed by federal law and outlined in your credit card agreement.

We'll keep you up to date on the status of your dispute by phone, written correspondence through mail and/or your Online Banking Message Center. If we need additional information to process your dispute, you may reply directly to our Message Center request (please note that your response needs to take place within 12 business days.)

You can track the status of your dispute in your Online Banking Messaging Center. The Claims Message Center allows you to track individual disputes as well as receive and reply to requests for additional information.