When you apply for a Bank of America business credit card, you will be asked for information about yourself, your company, and any additional cardholders you designate. To speed up the application process, it will be helpful to have several items on hand. These include:

Business information

- Business tax ID (or Social Security number for sole proprietors)

- Legal business name and structure

- Date business was formed

- Country and state of legal formation (formed in U.S. to apply online) and where you conduct your primary business operations (must be a U.S.-operating business)

- Gross Annual Sales and net profit

Beneficial Owner and Controlling Manager

- Name and title of person opening account

- Name and address of entity for the account

- Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for foreign individuals), residential address, country of citizenship, country of residence, and percentage of ownership for each Beneficial Owner

- Name, date of birth, Social Security number (U.S. Citizens), passport number and country of issuance (for foreign individuals), residential address, country of citizenship, country of residence for each controlling individual (this information is required even if no equity owner has 25% or greater ownership)

- Certification that information provided on the Beneficial Owner and/or controlling manager is accurate

Personal information for all card holders

- Social Security number (to verify your identity)

- Date of birth

- Address

- Valid email address

Your application will authorize Bank of America to obtain a credit report or other information to help verify application information. Bank of America works with Equifax for Small Business credit reporting. Small Business credit cards are backed by personal credit, however they are not included on your credit report as long as your credit card is in good standing.

Please note additional financial information or other documents may be requested prior to the completion of your application review.

To learn more, please visit this article on how to get a business credit card

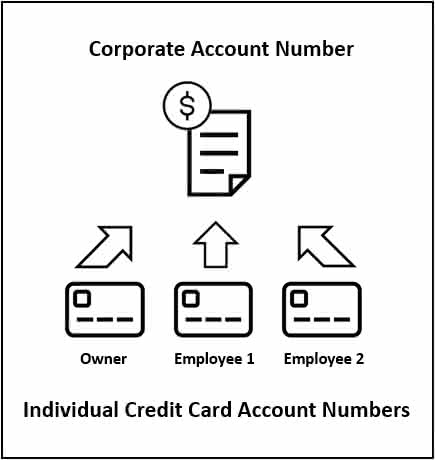

Small business owners benefit from using a small business credit card by separating business expenses from your personal expenses. This can help you manage your cash flow, help protect you from fraudulent charges, maintain control over your employee spending and help make tax preparation easier.

Plus you'll get the convenience of using a credit card for everyday purchases while earning cash or travel rewards (most cards) for your business. Finally, established businesses can use a small business credit card to start building credit for the business. A good small business credit history will be critical for when the business is ready to grow.

Protect yourself

Bank of America is the only major small business card issuer to ensure fairness and transparency to its clients as part of the CARD Act protections often called the Credit Cardholders Bill of Rights.

Rewards and APR

You can easily earn cash back or rewards points or miles using travel rewards cards. Most rewards cards also come with a 0% introductory APR followed by a variable APR. If APR is most important, choose a card with a lower APR.

Annual Fees

Most of our cards have no annual transaction fee, while other cards have a low annual fee with enhanced rewards. Choose the combination that’s best for your bottom line.

International Transaction Fees

If you travel overseas, choose a card with no international transaction fee like the Business Advantage Travel Rewards World Mastercard® credit card.

Business credit cards require the owner or an authorized officer who can borrow on behalf of the business to apply. Applicants should be U.S. residents or resident aliens with a US address (foreign business clients are not eligible to apply online at this time).

Yes, you can apply online. View and compare card features and benefits – and apply for the one that's right for you. Some applications may require further consideration and additional information from you.

Yes, your business name will appear below the individual cardholder name on each card that you request.

Application processing can be complete within 24 hours of application submission but is generally completed within 10-12 business days. You will be contacted via phone if there are questions related to your application or documentation required. As a regulatory requirement, a credit decision will be mailed to you within 30 days of application submission.

If approved, you'll normally receive your new card(s) within 7-10 business days from our receipt of your application.

There's no limit to the number of cards you can request. Existing clients can request additional cardholders by signing in to Online Banking, going to the Information & Services tab for the account and selecting Add authorized user under Services.

You can return to a saved application in the Application Center. We’ll need your name, email address, mother’s maiden name, date of birth, and business name.

If you saved your application more than 30 days ago, the application has expired and you'll need to start a new one. Sometimes offers and rates change, and a saved application may expire before 30 days. Access your saved application now