How HSA savings add up over time

For the Seavers, taking advantage of the HSA triple tax advantageFootnote1 is an important part of their plan for managing their current and future health care costs.

If Sally and Steve’s saving and spending rates are relatively consistent over the next 20 years, the balance in their HSA can be used to pay for medical expenses during their retirement. By using the HSA balance and tax savings calculator, the Seavers can see how their savings could add up over the next 20 years.

The Seavers entered the following assumptions into the calculator:

- Annual HSA contributions: $4,000

- Annual expenses to be paid with HSA savings: $2,000

- Federal income tax rate or bracket: 25%

- State income tax rate: 0%

- Interest rate or average annual rate of return: 2.5%

Based on these assumptions, in 20 years the Seavers will set aside $80,000 in their HSA for medical expenses. Without an HSA, their $80,000 would have been taxed like regular income, costing the Seavers $20,000 over the course of 20 years:

| Benefit of pretax contributions over 20 years | Without HSA | With HSA |

|---|---|---|

| Income set aside for family health expenses (before taxes) | $80,000 | $80,000 |

| Minus 25% federal income tax | $20,000 | $0 |

| Money left for family health expenses | $60,000 | $80,000 |

The hypothetical illustration assumes payroll deduction HSA contributions, a 25% tax bracket throughout participation, and does not consider any APR or effective rate of return. Changes in tax rates or tax treatment may impact the comparative results. Please consider your time horizon and income tax brackets, both current and anticipated, when making any decision, as these may further impact the results of the comparison. Hypothetical results are for illustrative purposes only and are not meant to represent the past or future performance of any specific investment vehicle or account. If you make pretax contributions to an HSA, taxes are due upon withdrawal if assets are not used for qualified medical expenses. For amounts invested in mutual funds: Investment return and principal value will fluctuate and when redeemed may be worth more or less than their original cost.

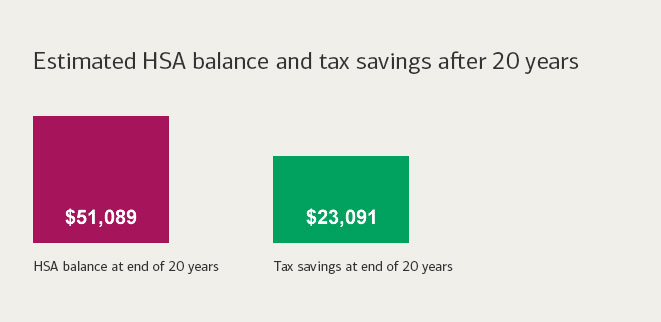

Together, the benefits of pretax contributions, tax-free withdrawals and tax-free gains would add up to significant savings for the Seavers over the course of 20 years. Based on the information they entered into the HSA balance and tax savings calculator, Sally and Steve learned that after their withdrawals for qualified medical expenses, they could have $51,089 in their HSA at the end of 20 years. And because they used an HSA, Sally and Steve would have $23,091 in total tax savings.

This hypothetical illustration assumes $4,000 annual pretax HSA contribution, $2,000 annual withdrawal for qualified medical expenses, 25% tax rate and 2.5% interest rate throughout participation. Calculations for total HSA balance and tax savings accumulated at the end of the 20-year period assume contributions and withdrawals are made in lump sum amounts at the end of each year. Changes in contributions, withdrawals, tax rates and tax treatment of investment earnings may impact results. Please consider your personal situation, investment time horizon and income tax brackets, both current and anticipated, when making any decision as these may further impact the results. Hypothetical results are for illustrative purposes only and are not meant to represent the past or future performance of any specific investment vehicle or account. If you make pretax contributions to an HSA, taxes are due upon withdrawal if assets are not used for qualified medical expenses. For amounts invested in mutual funds, investment return and principal value will fluctuate and when redeemed may be worth more or less than their original cost.